Diversification. We use this word a lot when we describe how the best portfolios are constructed, and it’s one of the keys to a successful investment strategy. The main idea is that a properly diversified portfolio will mitigate losses because different investments react to the same event in different ways. Our portfolios are comprised of many different parts – or as we say – are allocated to different asset classes. Each asset class has its own distinct focus but adds benefits in a composite way over the long term. The broad assets classes are:

Stocks:

- US Large Company

- US Mid-Sized / Small Company

- International Large Company

- International Small Company

- Emerging Markets

- Real Estate

Bonds:

- Short-Term

- Intermediate-Term

- Inflation-Protected (TIPS)

Most of these asset classes operate differently from each other to one degree or another over time. They have different risk and return characteristics: for instance, at the highest level, stocks are riskier than bonds, but they are expected to earn more. And each asset class has its own risk profile. For example, US Small Company stocks are generally riskier than US Large Company stocks; Emerging Market stocks are riskier than US Small Company stocks; intermediate-term bonds are riskier than short-term bonds. The riskier the asset class, the greater the expected return.

When all these elements are combined, we have a diversified portfolio. Or, to put it another way, instead of committing to a single, concentrated position, we are dividing the investment into a variety of different categories. This reduces the extremes in a portfolio and softens the blows of significant market downturns. For example, high-quality bonds of the type we have in our portfolios often hold their value during steep stock market downturns. During the 2020 pandemic crash, when US Large Company stocks lost 34% in three weeks, US Treasury Bonds were up 5%. Of course, the opposite is often true. Since that low point in March 2020, the US Large Company stocks bounced back and had a 94% cumulative return while a broad basket of US Treasuries lost 2%.

Why do we continue to hold one asset class when it might impair the portfolio's overall performance? Why hold bonds when stocks are going up? The simple answer is one of timing and the unpredictability of the markets. If we could know beforehand when one asset class would surge and another would decline, we would always trade for the better option. But that timing is impossible to get right consistently.

And this is evident in the performance of stocks and bonds over the past year. In the six months from July 1 to December 31, 2021, the best performing major asset class was US Large Companies which gained 10.3%, while short-term bonds were essentially flat (down 0.4%); in the subsequent six months from January 1, 2022, to June 30, 2022, the US market lost 18.2% while short-term bonds declined only 3.3%. They flip-flopped.

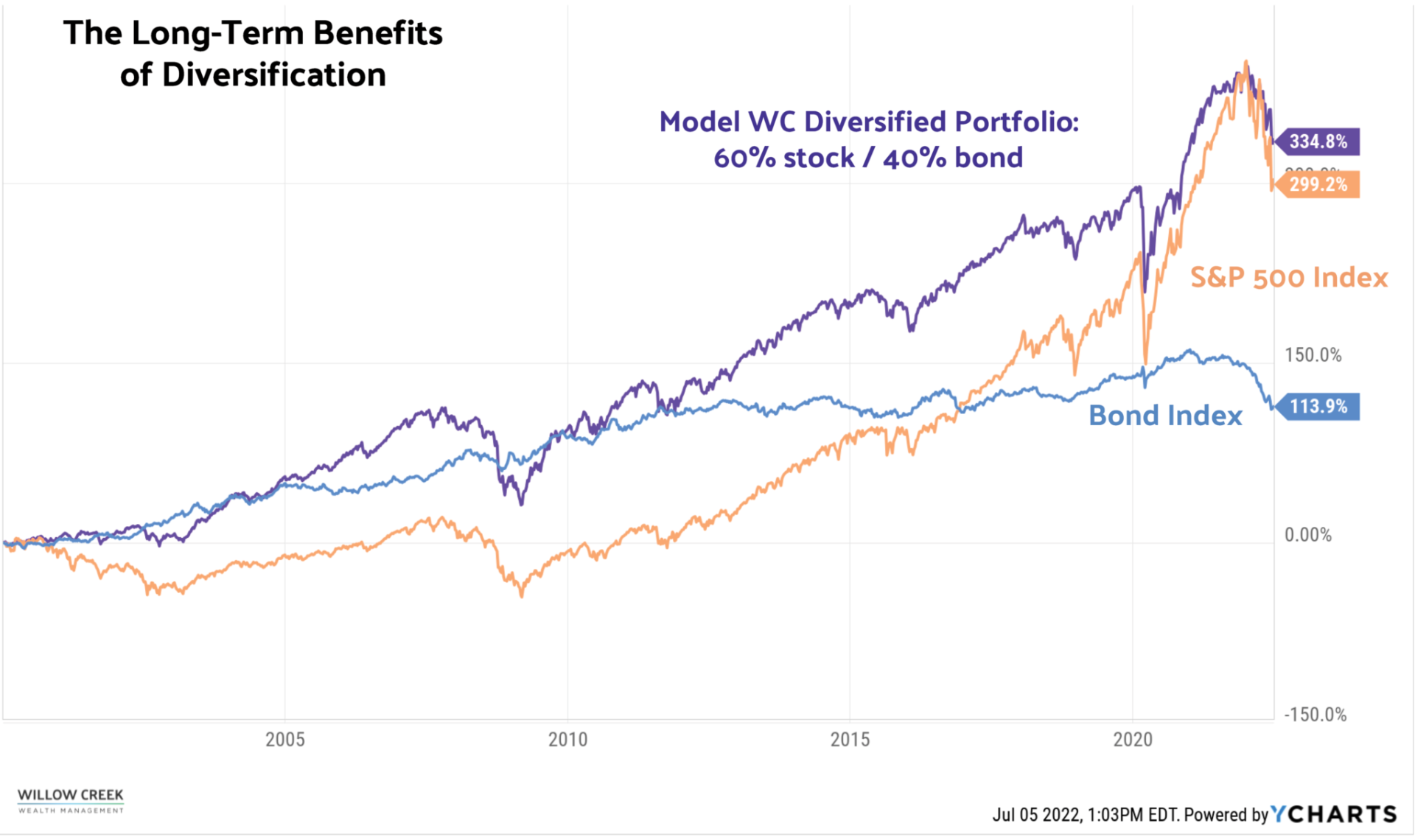

And this is not just a short-term phenomenon. If you look at the decade between 2000 and 2009, bonds, emerging markets, and international stocks far outperformed US stocks; from 2010 to 2019, the opposite was true: US stocks far outperformed bonds, emerging markets, and international stocks. But here is the crazy thing: if you held a simple diversified portfolio of 60% stocks and 40% bonds over this whole twenty-year period, you would have far outperformed both.

To paraphrase Warren Buffet, we do not know when the tide will change, but it will. When it does, we plan for our investors to have their bathing suits on.

Our portfolios are based on time-proven, evidence-based practices. They are meant to avoid investment fads like cryptocurrencies, "meme stocks,” or whatever has been trending in the financial press (or social media) at any given time. Although our allocations can have subtle adjustments, our investment philosophy always remains the same. We do not change allocations due to current market sentiment, flashy news headlines, or the latest trendy get-rich-quick idea. This might seem contrary to what many people expect their financial advisor to do, but it is a time-proven approach adopted by the world’s largest pension funds and academic endowments – stay the course. We’ve found, and studies have shown, that the most significant value we can add as advisors is not to react rashly to news or the market cycles and keep clients invested during volatile times.

It is the nature of a diversified portfolio that you will always wish you had more of one thing and less of another. But, like a baseball team over a long season, we know we will not win every game, and the star player will not hit a home run at every at-bat. A team with consistency and a solid foundation will have the best record at the end of a long season. What a diversified portfolio does is obtain a good return at a lower overall rate of risk. This means investors get a smoother ride and less stress in the long run. More than anything, a well-constructed portfolio is intended to last a lifetime. It is not meant to keep pace with every fad and craze, but to allow you to sleep at night and be at peace with your long-term investment plan.