But What if This Year is Different?

As advisors, we hear these predictions and concerns like clockwork every four years.

“The economy is going to be a mess if this candidate wins,” “this election is different than the past,” “maybe it’s time to exit the market entirely.”

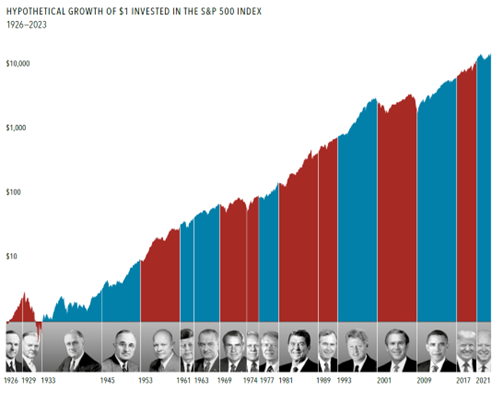

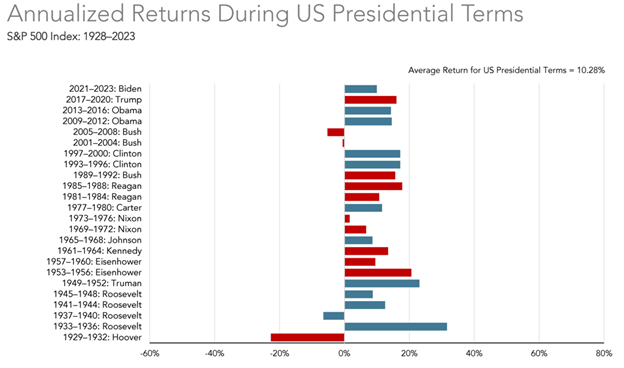

Think about the last few election cycles: Can you remember specifically what your fears were during the 2020 election? The 2016 election? How about the 2012 election? You likely remember your feelings during the 2020 election cycle most clearly; was that election different than all the rest? From a market and investment standpoint, it really was not. How about 2016? Again, it was another 4-year period of good market returns (14.27% average).

We always feel – or are being told – that this election will be the most impactful, important, and crucial election we have ever seen. That may very well be true, but for markets, those past election cycles that were supposed to be different than all the rest really were not.

The Risks of Drastic Changes

Even with all the historical context of previous elections, some investors will still feel more comfortable selling off some or all of their investments and waiting until sometime in the future to get back in. That could be a problem for several reasons.

- Getting out of markets often leads you to wait until you feel more comfortable with the state of things before getting back in. Are you going to buy back in when you see headlines like “the S&P 500 has hit all new highs,” or wait until you see the market drop further? Trying to time the market to avoid short-term events like an election may result in buying back at higher prices or sitting on the sideline indefinitely.

- We do not like to admit we were wrong. Investors that exit markets to avoid an event often will wait until prices are even lower than when they got out to buy back in. You could be sitting on the sideline for a long time and miss years and years of investment growth.

- People who tend to trade heavily for “election season” often end up trading for other headline events as well. This could lead an investor to fully abandon a long-term disciplined approach and lose significant amounts.

- In the heat of the moment, investors sometimes fail to consider the tax consequences of trading. Not only do you need to get the timing right, but you need to generate enough value to offset the increased tax consequences of short-term capital gains.

Nobel Prize-winning academics have shown that the market is efficient and has priced in expectations about the outcome of elections and other events. While unanticipated events in the future—surprises relative to those expectations—may trigger short-term market ups and downs, this is to be expected. As difficult as it is with all the media noise, the prudent investor tries to put aside emotions and political views recognizing the rewards of staying the course.